How To Create An Investment Strategy

Your Investment strategy is like your game plan to building your portfolio. But it is very important that you find the one that's right for your objectives and situation in life. A 25 year old should have a different strategy then a 65 year old.

We generally spend a decent amount of time planning for our workday, a vacation, and buying a car, but we often forget the most important plan of all: mapping out our investment strategy and plan for growing old and retiring.

Investing your money without an investment strategy is like a football team going into a game without a playbook. Although they are not required, they significantly improve your chances of winning. Creating an investment strategy should be your #2 step after you learn some of the basics of investing in the stock market like how to read stock quotes and how to buy stocks and other "getting started" info found here.

The Importance of Defining Your Investment Strategy

Most financial planners agree that the following are the beginning steps to a successful investment strategy:

- Stop paying high interest rates on credit cards and other debt.

- Try to save 10% of your income

- Have at least 3 months of expenses saved in cash

- Invest a fixed dollar amount each month in the stock market

- Plan on investing in stocks for at least 5 years

So, if you are at step 3 and ready to invest in the stock market, what stocks do you buy?

Having an investment strategy is like having an instruction booklet guiding you through the investment process. It will help you discard many potential investments that may perform poorly overtime or that are not right for the investment goals you are looking to achieve.

When creating an investment strategy, it is important to quantitatively figure out what you are seeking to accomplish. Stating that you simply want to make money or become wealthy is not helpful. A better objective would be to say "I want to achieve an 8% average annual return on my investment contributions over the next 10 years in order to have a $200,000 portfolio that will be used to purchase a 2nd home." The more specific the objective, the better. And it doesn't stop there. An investment strategy is useless without a proper understanding of it. There are many different strategies that apply to different investment objectives, the key is pairing the right strategy with the right objective.

Once you have gained some familiarity with the stock market terminology and are ready to take the next step, we have found this one newsletter is the BEST for beginner investors to GET THE BEST STOCK PICKS that have beat the market consistently over the last 5 years. In fact, their last 24 stocks picks have an average return of 111%. That means you would have more than doubled your money in 12 months had you bought just a little of each of their picks. Learn more about this newsletter and get their next stock 24 picks for only $99.

Types of Investment Strategies

Value Investing

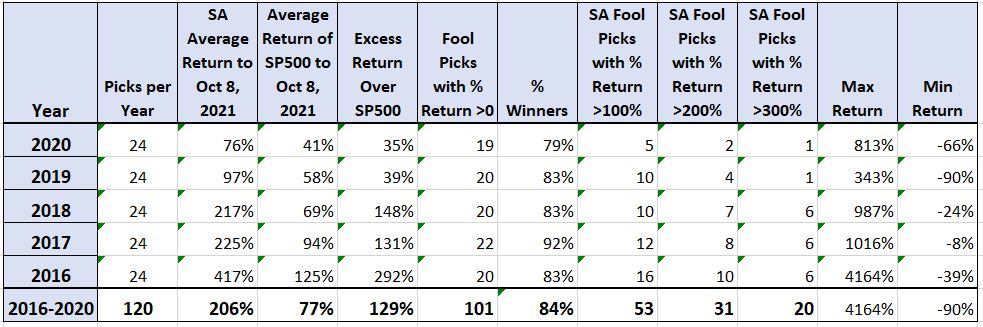

There are many investment types, but the most popular strategy, especially for beginners, is value investing. An investment strategy made popular by Warren Buffet, the principle behind value investing is simple: buy stocks that are cheaper than they should be based on their long-term earnings potential. Finding stocks that are under-priced takes a lot of research on the fundamentals of the underlying companies. And once you've found them, it may take a few months or years for their price to rise. This buy and hold technique requires a patient investor who wants to keep their money invested for a few years, which is why it's one of the best investment strategies for beginners. While the stock market has returned about 8% per year over the last 100 years, there are a few people like Warren Buffet whose stock picks have significantly outperformed the market as long term investment strategies. If you are planning on keeping your money invested in the stock market for at least 5 years and you want the best source for excellent "value stock" recommendations then consider the Motley Fool Stock Advisor. Take a look at the performance of the Motley Fool stock picks over the last 5 years, as of the date in the table:

The summary of the Motley Fool performance is this: Over the 5 year period from 2016 to 2020, the average return of all 120 of their stock picks is 206% and 84% of those picks are profitable. That means their stock picks beat the market by 129% Without a doubt, if you have at least $500 to invest in the stock market each month and you plan on leaving that money in the stock market for at least 5 years, the Motley Fool is the best place to get stock picks. If you are a new subscriber, you can get the next 12 months of their stock picks for only $99. All investors should understand at least the basics of value investing.

Income Investing

A great way to build wealth over time, income investing involves buying securities that generally pay out returns on a steady schedule. Bonds are the best known type of fixed income security, but the income investing strategy also includes dividend paying stocks, exchange-traded funds (ETFs), mutual funds, and real estate investment trusts (REITs). Fixed income investments provide a reliable income stream with minimal risk and depending on the risk the investor is looking to take, should comprise at least a small portion of every investment strategy.

Growth Investing

An investment strategy that focuses on capital appreciation. Growth investors look for companies that exhibit signs of above-average growth, through revenues and profits, even if the share price appears expensive in terms of metrics such as price-to-earnings or price-to-book ratios. What Warren Buffet did for value investing, Peter Lynch did for growth investing. A relatively riskier strategy, growth investing involves investing in smaller companies that have high potential for growth, blue chips and emerging markets.

Small Cap Investing

An investment strategy fit for those looking to take on a little more risk in their portfolio. As the name suggests, small cap investing involves purchasing stock of small companies with smaller market capitalization (usually between $300 million and $2 billion). Small Cap stocks are appealing to investors due to their ability to go unnoticed. Large-cap stocks will often have inflated prices since everyone's paying attention to them. Small cap stocks tend to have less attention on them because: a) investors stay away from their riskiness and b) institutional investors (like mutual funds) have restrictions when it comes to investing in small cap companies. Small cap investing should only be used by more experienced stock investors as they are more volatile and therefore difficult to trade.

Socially Responsible Investing

A portfolio built of environmentally and socially friendly companies while staying competitive alongside other kinds of securities in a typical market environment. In today's modern world, investors and the general public expect companies to maintain some social conscience, and they're putting their money where their mouth is. SRI is one path to seeking returns that poses a significant collateral benefit for everyone.

How Choose An Investing Strategy That's Right For You

Setting up your investment strategy is like buying a new car, before you look at the different models, you need to figure out what style suits you best. And just like cars, there are many investment types to choose from when creating an investment strategy. When choosing the right investing strategy, there are questions that need to be answered first. What is your investment horizon? What returns are you seeking to achieve? What amount of risk are you able to tolerant? What are the funds in this investment to be used for? Answering these questions will ultimately also help in building your portfolio.

Determining what will be your breakdown between cash, fixed-income securities and stocks is a good start towards creating your investment strategy. The breakdown of your asset allocation ultimately depends on your risk tolerance. A conservative investor may prefer to hold 80% of his portfolio in fixed-income and 20% in stocks. The reverse would be true for an aggressive investor, while a balanced investor will follow a 50-50 split.

In terms of specific investment strategies within your asset allocation, if you are a high risk investor with a long investment horizon, you may want to include small cap and growth investing in your portfolio. If you have a moderate risk tolerance and shorter investment horizon, you may be more suitable for value and income investing. If you have a low risk tolerance and short investment horizon, you may want to focus solely on income investing. For those looking for companies that aim to do no harm, you can add socially responsible assets to your portfolio with relative ease. It is also important to adapt to the investment strategy you are most comfortable with. Someone with a knack for choosing growth stocks may make that strategy the priority in their portfolio.

THE 3 BEST TOOLS FOR BEGINNER INVESTORS

Updated November 6, 2021: At WallStreetSurvivor, our passion is helping you learn to invest in the stock market the RIGHT WAY! As part of our commitment to you, we are constantly evaluating all types of financial tools from stock picking newsletters to brokerage apps to stock screeners and more. Here are our favorites:

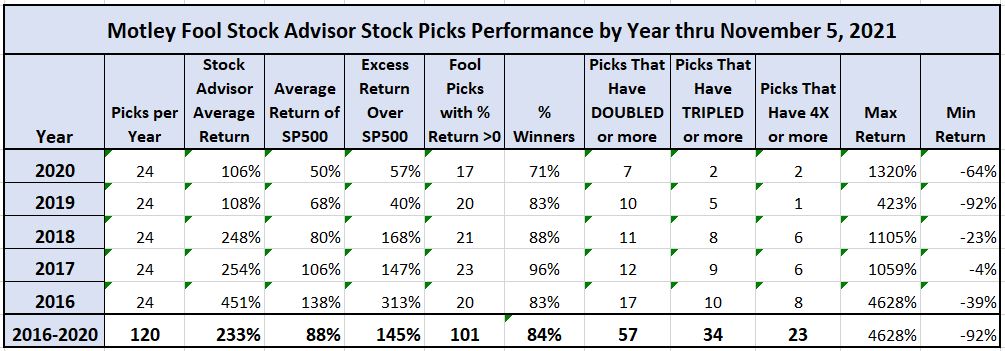

1. BEST SOURCE OF STOCK PICKS FOR THE LAST 5 YEARS

We have been tracking ALL of the Motley Fool stock picks since January 2016. That's over 5 years and 120 stock picks. Take a look at their stock picks' performance for the last 5 years:

- Average return of their 120 picks from 2016 to 2020 is 233%

- That beats the SP500's 88%

- 84% of their picks are up

- 57 of those 120 stocks have doubled

Now, no one can guarantee that their next picks will be as strong, but our 5 years of experience has been super profitable as you can see. They do pick some losers, but the key for investors is to invest equal dollar amounts in all of their picks. So if you have $1,000 to invest in the market each month, buy $500 of each of their 2 monthly stock picks.

Normally the Motley Fool service is $199 per year but they are currently offering it at their lowest price ever: Just $79 for 12 months..

CLICK HERE to get the next Motley Fool Stock Pick

2. BEST STOCK BROKERAGE ACCOUNT

Robinhood was the first brokerage site to NOT charge commissions when they opened in 2013. They just past 10,000,000 accounts and to celebrate they are offering one free share of stock (value up to $250) when you open a new account. In addition, they will give you another free share of stock (up to $250) for each friend that you refer, max 3 friends a year.

Here's the details: You must click on a special promo link to open your new Robinhood account. Then when you fund your account with at least $10, you will receive one stock valued between $5 and $250. Then, you will get a link to share with your friends. Every time one of your friends opens an account, you will receive another free stock valued between $5 and $250.

Claim your free stock NOW

3. FIVE STOCKS LIKELY TO DOUBLE

ZACKS Investment Research just released their list of 5 Stocks Likely to Double. ZACKS has been around since 1978 and their top rated stocks have an average gain of 25.35% per year over the last 30+ years. Best of all, you can get this list of 5 stocks for FREE by CLICKING HERE.

BEST STOCK NEWSLETTER: The Motley Fool Stock Advisor has won our award for the Best Stock Newsletter 4 years in a row with average stock pick up 233% since 2016. New Subscribers can try the service now for just $19.

How To Create An Investment Strategy

Source: https://www.wallstreetsurvivor.com/starter-guides/investment-strategies/

Posted by: fletchersetime.blogspot.com

0 Response to "How To Create An Investment Strategy"

Post a Comment